Stand out while taking a stand

At Emit Capital Asset Management, we believe that financial performance and positive impact are not mutually exclusive. By investing in climate solutions, you not only enhance your portfolio but also contribute to a sustainable future. Our commitment to impactful investing sets us apart, and we invite you to join us on this journey.

Watch our Institutional video below to see how ECAM is leading the way in climate finance and discover the tangible benefits our strategies can bring to your investments.

Discover how you can stand out while taking a stand with Emit Capital Asset Management

Unlock the Power of Real-Time Climate Finance Analysis

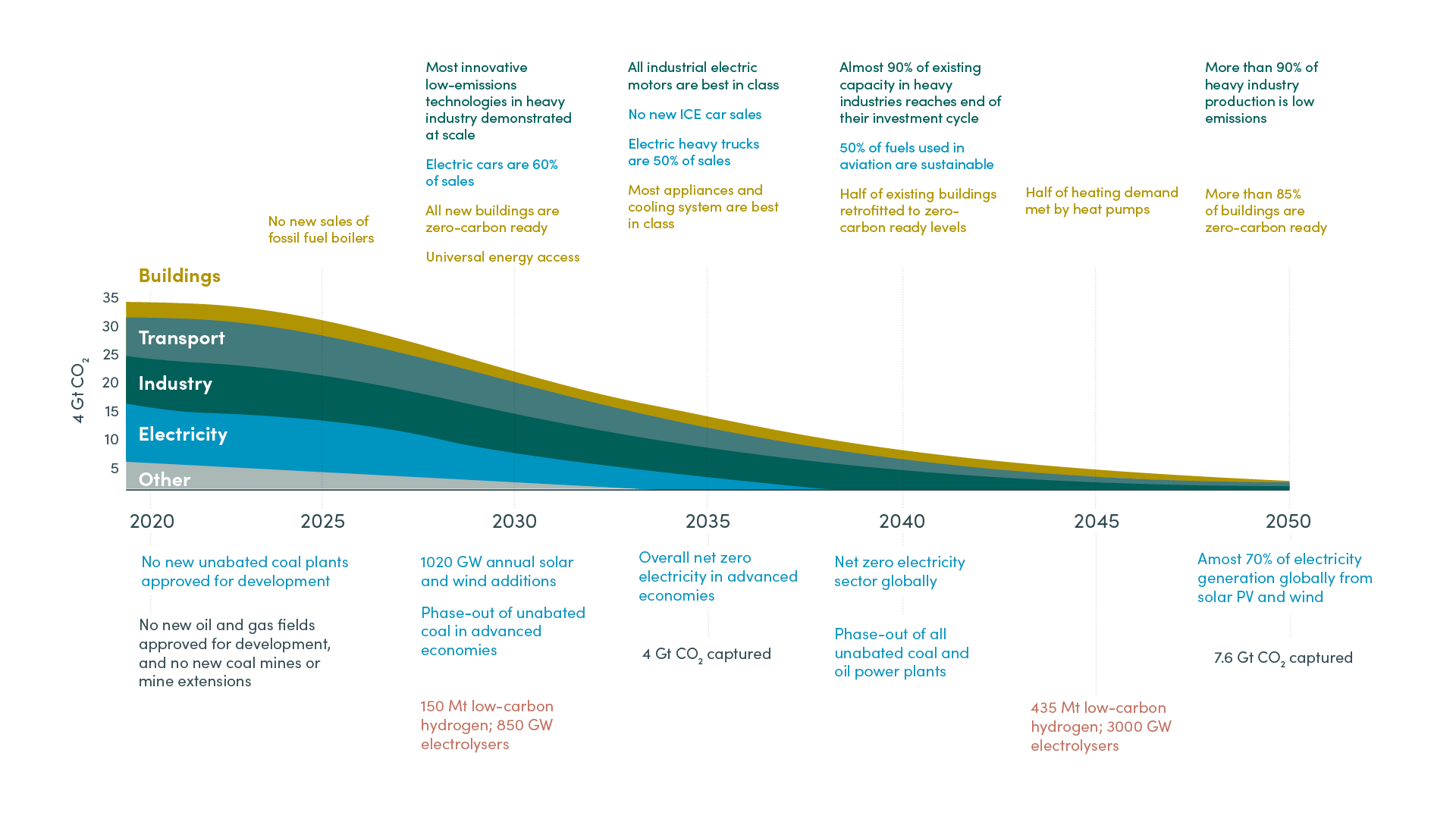

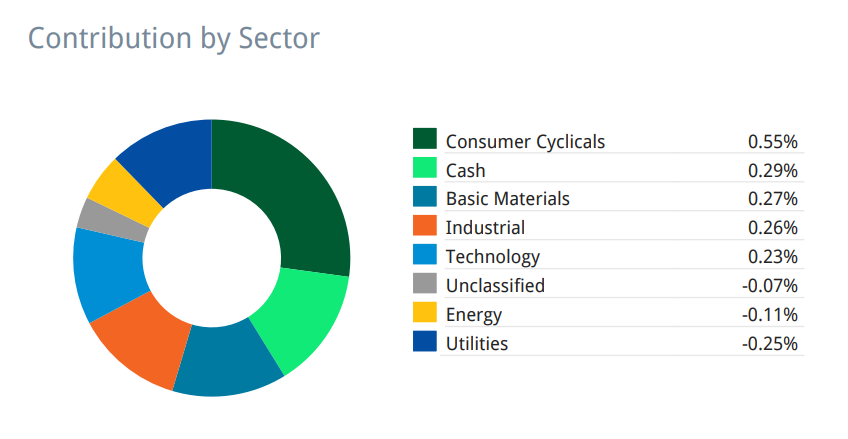

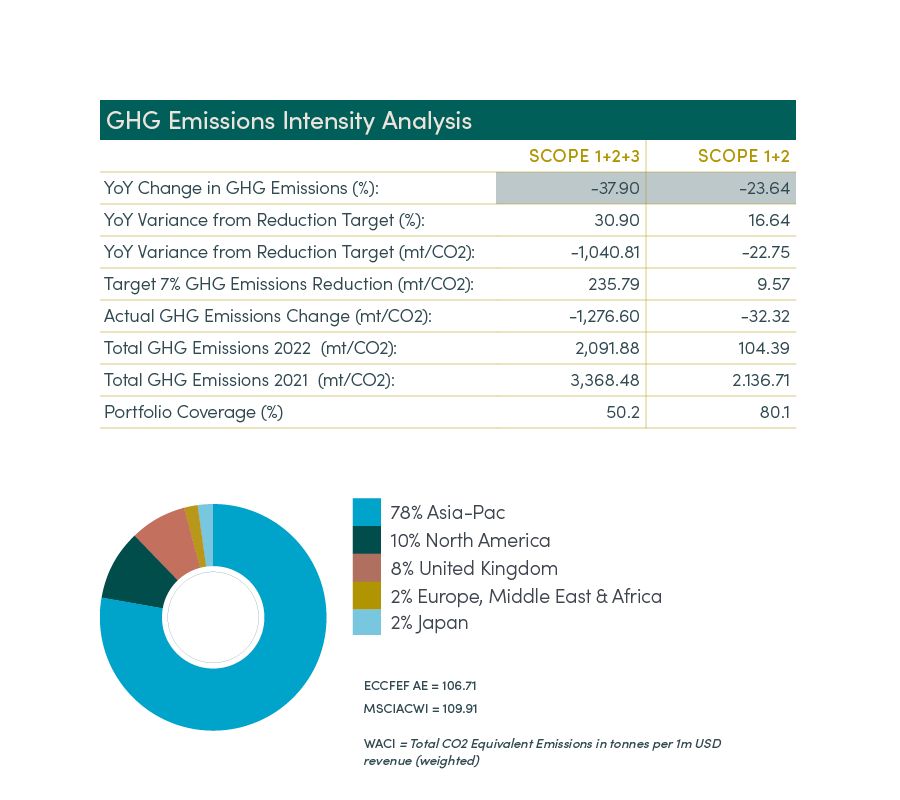

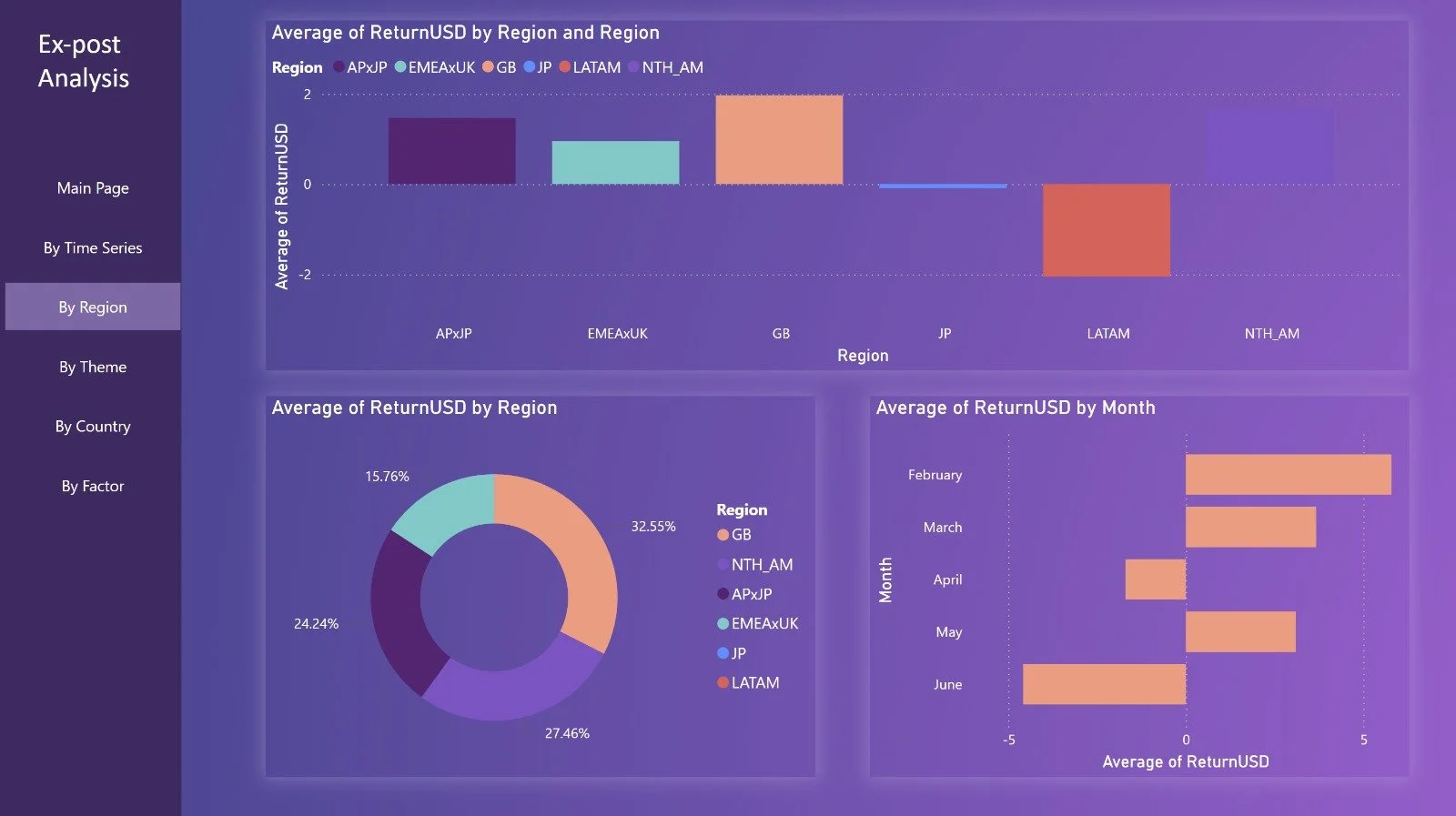

At Emit Capital Asset Management, we are not just navigating the future of climate finance—we are shaping it. Our commitment to transparency and innovation is reflected in our latest offering: real-time data analysis powered by our bespoke dataset and presented via our in-house software. The analysis will include 2 important components: (1) Overall portfolio analysis including risk and return, and (2) Responsible Investment analysis which drives our climate finance thematic strategy.

Why Partner with Us?

In today's dynamic financial landscape, timely and accurate information is essential for making informed investment decisions. That's why we are developing a cutting-edge client desktop portal, offering real-time analytics and insights, available 24/7. This platform goes beyond delivering raw data—it provides actionable intelligence designed to give you a competitive advantage in fast-moving markets.

Our platform goes beyond being a mere tool—it's a true partnership. We are committed to working closely with institutional and professional clients to continuously evolve and optimize the platform, tailoring it to your unique requirements. This means that you won’t just be accessing information; you’ll have a direct influence on how that information is presented and applied, giving you greater control and insight to drive more informed decisions.

Your Competitive Edge in Climate Finance

Imagine having a customised portal at your fingertips, tailored to your exact requirements, offering unparalleled insights into the markets that matter most to you. Whether you are an investor seeking granular, real-time analysis or a broader view of climate finance trends, our platform is designed to deliver.

Powerful Analytics at Your Fingertips

Our real-time data platform allows you to access and analyse a wide range of metrics, providing insights that are both deep and broad:

-

Visualise how different sectors or themes are performing across various geographies, enabling you to identify trends and opportunities that align with your investment strategy.

-

Assess the risk profiles of various investments, leveraging our data to understand potential exposures and make informed decisions that mitigate downside risk.

-

Track the historical performance of our investments by theme, region, and sector, gaining insights into past trends that can inform future strategies.

-

Delve into detailed sector analysis, understanding how different industries are performing within the broader climate finance landscape.

-

Tailor the analytics and visualisations to meet your specific needs, ensuring you always have the most relevant data at your disposal.

-

Stay up to date with real-time reporting on our portfolio carbon footprint, Environmental, Social, and Governance (ESG) metrics and impact principles. This transparency allows you to ensure investments align with your values and stay informed on the positive changes your investments are driving.

What You’ll Gain

Real-Time Insights: Access live data that’s continuously updated, giving you a minute-by-minute view of key metrics and trends in the climate finance sector.

Customization: Our portal is built with flexibility in mind, allowing you to tailor the information and analysis to suit your specific strategies and objectives.

24/7 Availability: Markets never sleep, and neither does our data. Whether it's early morning or late at night, you’ll have access to the insights you need when you need them.

A Commitment to Transparency

Transparency is the foundation of our approach. When you partner with Emit Capital Asset Management, you gain more than just data access—you gain insight into our processes, strategies, and our unwavering commitment to creating positive impact through climate finance. We believe that transparency fosters trust, and trust drives stronger, more successful outcomes for all stakeholders.

See the Future of Climate Finance

Our beta screenshots provide a preview of the potential our platform holds, but this is only the start. With your feedback and collaboration, we're ready to elevate it further, delivering a fully customized, powerful solution designed to give you a competitive edge in the market.

Ready to make a difference?

We invite you to take the next step towards impactful investing with Emit Capital Asset Management. We are ready to discuss how our unique strategies can align with your investment goals and contribute to a sustainable future.

Contact Us Today

Call us on +61 3 9593 2866 or email us here to arrange a meeting with our investment team. Let’s explore how we can work together to achieve both outstanding financial performance and meaningful environmental impact.